SBI introduces savings account minimum balance requirement

from April 1Minimum balance requirement varies depending on geographies,

say SBISBI requires savings bank account holders in metros to maintain

Rs 5,000

SBI savings bank account holders urban areas need to maintain an average balance of Rs 3,000

State Bank of India or SBI has

introduced minimum balance requirement in savings accounts from April

1. The minimum balance requirement for SBI customers varies depending on

geographies such as metro, urban, semi-urban and rural. If the minimum

balance drops below a particular threshold, SBI will charge a fee from

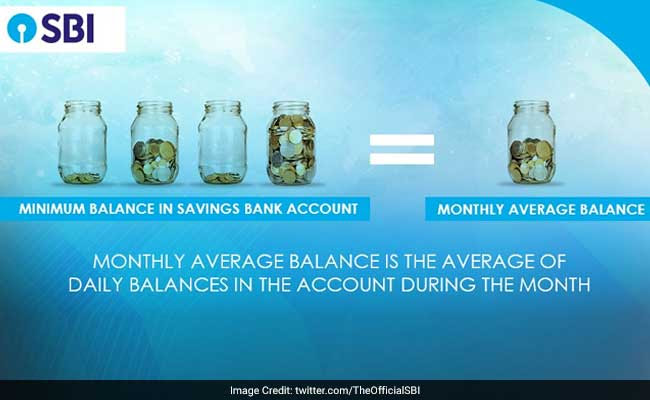

the account holder. SBI says the minimum balance in your savings bank

account is the monthly average balance - the average of daily balances

in the account during the month. SBI requires its savings bank account

customers in metros to maintain a monthly average balance of Rs 5,000.

Holders of SBI's savings bank account in urban areas need

to maintain a monthly average balance (MAB) of Rs 3,000, Rs 2,000 in

case of those in semi-urban areas and Rs 1,000 in rural areas. This was

said on Thursday by SBI - which recently merged its operations with six other banks - on Twitter.

Hitting 31 crore depositors, SBI will charge a fee ranging

from Rs 50 to Rs 100 plus service tax in case of non-compliance with

minimum balance requirements.For metropolitan areas:Shortfall SBI

chargesOver 75%Rs 100 plus service tax50-75%Rs 75 plus service taxUnder

50%Rs 50 plus service taxFor rural areas, the penalty for

non-maintenance of minimum balance ranges from Rs 20 to Rs 50 plus

service tax.Meanwhile, SBI offers other types of accounts where it

customers are not required to maintain a minimum balance.

Small savings bank account and basic savings account are two such

products offered SBI.State Bank of Bikaner and Jaipur, State Bank of

Hyderabad, State Bank of Mysore, State Bank of Patiala and State Bank of

Travancore, besides Bharatiya Mahila Bank (BMB), became part of SBI

with effect from April 1. After the merger, SBI has entered the league

of top 50 global banks with a balance sheet size of Rs 41 lakh crore,

2.77 lakh employees, 50 crore customers, over 22,500 branches and 58,000

ATMs.

No comments:

Post a Comment